Resources

Videos and Articles

Entity Type:

Content Type:

Industry:

- All

- Automotive

- Business Services

- Construction

- Consumer Goods

- Consumer Products

- Energy

- Financial Institutions

- Financial Services

- Food and Beverage

- Food Beverage

- Government

- Health Care

- Healthcare

- HIPAA HITECH Compliance

- Hospitality

- Life Sciences

- Manufacturing

- Nonprofit

- Private Equity

- Professional Services

- Real Estate

- Real Estate Construction

- Real Estate Funds

- Restaurant

- Retail

Service:

- All

- Accounting

- Audit

- Business Applications

- Business Process Outsourcing

- Business Strategy

- Business Tax

- Business Transformation and Improvement

- Cloud Computing

- Compensation and Benefits

- Consulting

- Credits and Incentives

- Cybersecurity Risk

- Data and Analytics

- Digital Transformation

- Employee Benefit Plans

- Enterprise and Strategy Risk

- ERP and CRM

- Family Office Services

- Federal Tax

- Financial Advisory

- Financial Management

- Financial Reporting Resource Center

- Global Audit

- Governance, Risk and Compliance and Enterprise Risk Management

- International Tax Planning

- Investment Advisory

- Managed Services

- Management Consulting

- Mergers & Acquisition

- Mgmt Cons Archives

- Operations and Supply Chain

- PCAOB

- People and Organization

- Private Client

- Private Client Services

- Public Companies

- Regulatory Compliance

- Retirement Plan Advisory

- Risk Advisory

- Risk Consulting

- SEC

- Security and Privacy

- State and Local Tax

- Strategy and Management Consulting

- Tax

- Technical Accounting Consulting

- Technology Consulting

- Technology Risk

- Washington National Tax

- Wealth Management

Topic:

- All

- AICPA Matters

- Anti-money Laundering

- Artificial Intelligence

- ASC 842

- Blockchain

- Board Insights

- Business Growth

- Buying Patterns

- CARES Act

- CECL

- Coronavirus

- Covid-19

- Cryptocurrency

- Cybersecurity

- Cybersecurity and Data Breach

- Digital Assets

- Distressed Real Estate

- Economics

- Election 2020

- Employee

- Employee Benefit Plan Services

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Fund Management

- Global

- Inflation

- Labor and Workforce

- Lease Accounting

- Leases

- Management Consulting Blog

- Owner

- Payroll and Employment

- People

- Policy

- Recent accounting updates

- Regulations and Compliance

- Regulatory Compliance

- Revenue Recognition

- Risk and Opportunity

- Risk Management

- SEC Matters

- State Tax Nexus

- Succession Planning

- Supply Chain

- Tax Base

- Tax Reform

- Technology and Data

Early retirement withdrawals: avoiding the 10% penalty

Uncover potential circumstances under which you can tap into your retirement savings early without facing hefty penalties. From qualifying plan specifics to the latest updates in IRA rules, this article is your go-to resource for penalty-free withdrawal strategies.

What To Do With Old Retirement Accounts

You likely have at least one old retirement account if you've ever changed employers. These accounts stay exactly as you left them unless you take action. In this video, we'll provide options for what to do with those old accounts.

The 1031 Exchange Explained

In the world of real estate, the Section 1031 exchange has been a significant tool for investors who want to grow their real estate portfolio and wealth. In this video, we'll explain how a 1031 exchange works and important considerations when using one.

IRS delays implementation of lowered form 1099-K reporting threshold

The IRS has postponed the implementation of the new lowered reporting threshold for Form 1099-K. Learn more about this tax form and the impact of this delay on your financial planning.

Tax, Retirement, and Social Security changes for 2024

Are you prepared for the tax, retirement, and Social Security changes coming in 2024? Stay ahead with our expert insights and start planning your financial strategies today.

The DOL’s latest overtime proposal could impact your payroll

The DOL has a new overtime proposal on the table, and it could have major implications for your payroll. Learn about the potential changes and how they could impact your business operations.

Delaying retirement: a strategic move for financial security

Considering delaying retirement for better financial stability? This article explores the strategic advantages of working a few more years before you finally call it quits. Discover how this decision can significantly impact your financial security.

Maximizing your property’s potential: the Augusta Rule explained

Discover the tax benefits of the lesser-known Augusta Rule, where homeowners can enjoy tax-free income by renting out their properties for up to 14 days per year. Uncover how this can also serve as a unique tax strategy for business owners to claim deductions. Learn the eligibility criteria, potential pitfalls, and best practices to harness this opportunity.

End-of-year tax update: IRS news and strategic moves for 2023

Stay ahead with our end-of-year tax update for 2023, providing the latest IRS news and strategic moves you need to know. Discover key information to help you navigate your taxes efficiently and effectively.

Inflation is cooling, but key costs pose a challenge for food and beverage companies

Middle market food and beverage companies developing growth strategies will continue to navigate a challenging cost environment.

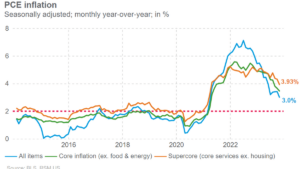

Inflation slows again, pointing to another rate pause

The personal consumption expenditures price index, the Federal Reserve's favorite inflation metric, was unchanged on the month, while the core measure rose by 0.

U.S. existing home sales plunged to their lowest level since 2010

In October, sales of existing homes dropped to 3.79 million, marking the lowest point since 2010, the National Realtor Association reported on Tuesday.

IRS issues guidance on the transfer of clean vehicle credits

The IRS and the Treasury Department have released guidance on how buyers can transfer clean vehicle credits to dealers at the time of purchase.

Are ESOPs a good fit for business and professional services (BPS) companies?

ESOPs can be advantageous to BPS companies, but their success ultimately depends on several key factors - culture, messaging and ownership goals.

4 pitfalls of using multiple human resources information systems

Managing data across multiple HRIS platforms doesn't have to be as daunting as it sounds, but there are four pitfalls to avoid.