Resources

Videos and Articles

Entity Type:

Content Type:

Industry:

- All

- Automotive

- Business Services

- Construction

- Consumer Goods

- Consumer Products

- Energy

- Financial Institutions

- Financial Services

- Food and Beverage

- Food Beverage

- Government

- Health Care

- Healthcare

- HIPAA HITECH Compliance

- Hospitality

- Life Sciences

- Manufacturing

- Nonprofit

- Private Equity

- Professional Services

- Real Estate

- Real Estate Construction

- Real Estate Funds

- Restaurant

- Retail

Service:

- All

- Accounting

- Audit

- Business Applications

- Business Process Outsourcing

- Business Strategy

- Business Tax

- Business Transformation and Improvement

- Cloud Computing

- Compensation and Benefits

- Consulting

- Credits and Incentives

- Cybersecurity Risk

- Data and Analytics

- Digital Transformation

- Employee Benefit Plans

- Enterprise and Strategy Risk

- ERP and CRM

- Family Office Services

- Federal Tax

- Financial Advisory

- Financial Management

- Financial Reporting Resource Center

- Global Audit

- Governance, Risk and Compliance and Enterprise Risk Management

- International Tax Planning

- Investment Advisory

- Managed Services

- Management Consulting

- Mergers & Acquisition

- Mgmt Cons Archives

- Operations and Supply Chain

- PCAOB

- People and Organization

- Private Client

- Private Client Services

- Public Companies

- Regulatory Compliance

- Retirement Plan Advisory

- Risk Advisory

- Risk Consulting

- SEC

- Security and Privacy

- State and Local Tax

- Strategy and Management Consulting

- Tax

- Technical Accounting Consulting

- Technology Consulting

- Technology Risk

- Washington National Tax

- Wealth Management

Topic:

- All

- AICPA Matters

- Anti-money Laundering

- Artificial Intelligence

- ASC 842

- Blockchain

- Board Insights

- Business Growth

- Buying Patterns

- CARES Act

- CECL

- Coronavirus

- Covid-19

- Cryptocurrency

- Cybersecurity

- Cybersecurity and Data Breach

- Digital Assets

- Distressed Real Estate

- Economics

- Election 2020

- Employee

- Employee Benefit Plan Services

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Fund Management

- Global

- Inflation

- Labor and Workforce

- Lease Accounting

- Leases

- Management Consulting Blog

- Owner

- Payroll and Employment

- People

- Policy

- Recent accounting updates

- Regulations and Compliance

- Regulatory Compliance

- Revenue Recognition

- Risk and Opportunity

- Risk Management

- SEC Matters

- State Tax Nexus

- Succession Planning

- Supply Chain

- Tax Base

- Tax Reform

- Technology and Data

U.S. retail sales show surprising resilience

Total retail sales jumped 0.7% on the month, while February's number was revised up to 0.9% from 0.6%.

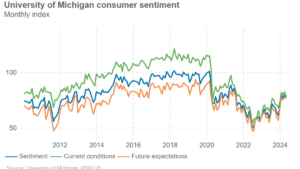

U.S. consumer sentiment falls as inflation stays sticky

The University of Michigan's consumer sentiment index fell to 77.9 in April from 79.4, according to data released on Friday.

Understanding money mule networks: a covert financial threat

Money mule networks are a growing concern where criminals use deceptive tactics to launder money through unsuspecting participants. Learn how to spot the signs and protect yourself from these criminal schemes.

Policy changes: Social Security Administration’s new approach to overpayments

The Social Security Administration's approach to overpayments is changing, bringing potential changes to your benefits. Explore these policy changes and how they may help you retain more of your monthly checks.

Proactive Tax Strategies for High-Earning Taxpayers

The IRS has issued clear warnings about its increased scrutiny of high-net-worth individuals, especially those using risky tactics to reduce tax obligations. This video provides strategies for optimizing your financial situation while staying within the bounds of the law.

Financial reset: strategizing for a prosperous year ahead

Set your financial targets for the year with this comprehensive guide that uses the SMART framework. Learn about strategies for debt repayment, evaluating your emergency fund, and early tax planning. If you need more guidance, our office is ready to provide personalized advice.

Planning to downsize? Three tax considerations for retirees

Downsizing in retirement isn't just about reducing living expenses—it can also be a strategic move toward financial security. Understand how your home's appreciation impacts your taxes and discover strategies to reduce your tax burden.

One year later: 5 areas of regulatory focus since 2023 bank failures

In the aftermath of the liquidity-related bank failures in March 2023, regulatory agencies and leaders have released numerous updates on supervisory expectations and calls for additional regulation.

Credits and incentives available to retirement plan sponsors

Employers with less than 100 employees who have recently adopted or are considering a retirement plan have a tax savings opportunity.

Mitigating the Risk of Deepfake Fraud

With the rise of AI, deepfake fraud is on the rise, resulting in significant financial losses for companies. Explore the need for increased employee education and enhanced security measures. Reach out to us to learn how to protect your organization against these sophisticated cybercrimes.

Exploring holding companies: how they work and why they matter

Holding companies offer benefits such as tax efficiency, liability protection, and privacy, but they also present challenges and complexity. This article provides an overview of what holding companies are, how they work, and their pros and cons.

IRS cautions against companies misrepresenting wellness and nutrition expenses as medical costs

The IRS has issued a warning against companies misrepresenting personal health and wellness expenses as medical expenses. Understand the potential tax implications and how to use your health spending accounts responsibly. Keep yourself informed and avoid falling victim to these misrepresentations.

Understanding the Form 8300 e-filing requirements for cash transactions over $10,000

Understand the IRS's new e-filing system for Form 8300, designed to simplify the reporting of cash transactions over $10,000. Learn who must file, the e-filing requirements, and how to apply for a waiver if e-filing is challenging for your business.

Fiscal year 2025 budget proposal contains items affecting exempt organizations

Biden administration's budget proposal includes items affecting donor advised funds and private foundations.

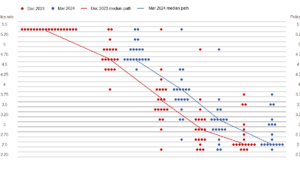

Fed holds rates steady as it implies three rate cuts in 2024

The primary takeaway from the Federal Open Market Committee's policy statement and forecast is that the Fed, along with other major central banks.